We’ve covered a number of areas of personal injury law on our website but we haven’t until now written about TPD Claims, or in other words claims for Total and Permanent Disability benefits.

What is a TPD insurance benefit?

A TPD (Total and Permanent Disability) insurance benefit or disability insurance benefit is a payment which can be claimed as a lump sum to those who become totally and permanently disabled due to illness or injury. Most people are covered for a TPD benefit under their superannuation fund, yet research shows that less than half of people with superannuation are aware of what TPD coverage applies to them.

A TPD benefit is normally payable in addition to the contributions made by your employer or you into your superannuation fund.

What can a TPD benefit be used for?

A TPD benefit can be used to cover a variety of financial costs such as:

- Medical and rehabilitation expenses.

- Necessary home modifications due to injuries or illnesses.

- Payments of mortgages, loans, or debts.

- Financial support for dependants of injured or ill claimant.

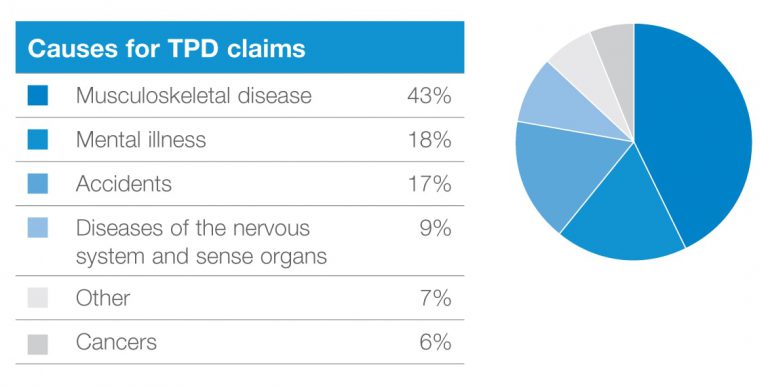

What conditions are covered under a TPD benefit?

Medical conditions covered under a TPD benefit can include physical or psychological injury, diseases, or other medical disorders. TPD Insurance can cover permanent injuries or disabilities caused by accidents, illnesses or conditions caused by sporting incidents, depending on your level of cover.

Who can claim TPD and what are the requirements for making a claim?

You may be eligible to make a claim for TPD, if:

- You have ceased your employment and/or duties as a result of an illness and/or injury (please note that this does not mean your employment must be formally terminated).

- You are unlikely to return to your employment/duties as a result of this illness/injury.

- You were under the age of 65 years when you ceased this employment.

- You were a member of a Superannuation Fund at the time you ceased your employment and had TPD Insurance at the time you became unwell or were injured.

Can you make a TPD claim due to mental illness?

TPD claims due to mental illness can be made if the mental condition affects your ability to work, however it will depend on the circumstances of your case, so it is best to seek legal advice prior to making your TPD claim.

Do I have TPD cover? How do I know if I have TPD insurance?

You will need to have a look at your current Superannuation Statement. If you are covered for TPD, it will normally be located near the Death Benefit including the amount you are insured for.

What are my rights?

Any rights that you have are governed under your policy document. GC Law will need to review the Superannuation Fund Policy Document carefully before we are able to advise you in relation to your rights.

What can I expect in the TPD claim process?

- The TPD Claim process can be quite lengthy and complex. An investigation with your superannuation fund will need to be undertaken to confirm your TPD cover and obtain the policy document.

- A detailed statement will need to be obtained from you in relation to your vocation, work experience/qualifications, injury and illnesses and work history.

- Further, all medical evidence by way of a medico-legal report from an independent specialist (this means you will need to attend at an appointment for examination); medical records from your treating practitioners and any other material.

- The Claim form together with submissions will then be prepared on your behalf for lodgement with the superannuation fund.

- The fund will then decide as to whether they accept or reject your claim.

The information provided above is a short run down on the process. It is difficult to determine the length of time for the process as we are dealing with third parties to obtain information.

How long does a TPD payout take?

The amount of time that it takes for a TPD claim to be successfully lodged and then for you to receive payment can take anywhere between two and three months, depending on your case. This may vary greatly, based on the nature of your claim.

How much will I get from my TPD claim?

How much you will get from your TPD claim is typically determined by your superannuation fund’s insurance policies, your likelihood of returning to work and your age when you stopped working. The amount that you are entitled to from your insurance benefit can change over time, so it is important that you seek legal advice when making your TPD claim, even if your super fund is telling you that you are not currently insured.

Does a TPD payout affect Centrelink?

TPD payments are not considered income or compensation for Centrelink purposes so they should not affect your Centrelink payments as the TPD payout is paid within super. After the claimant has accessed the TPD and their super, this could affect Centrelink entitlements, depending on your situation.

Is there a time limit to make a claim?

- There may be time limits in lodging a claim against your Superannuation Fund for TPD benefits. Failing to comply with these time limits could mean the end of your claim.

- Most funds require you to be absent from work for a continual period of at least 6 months before you will qualify to make a claim for TPD.

- If your claim is rejected by the fund after lodgement, you will have six years from the date the claim is rejected to file proceedings in the court, if necessary.

Can I have a TPD claim at the same time as a workers’ compensation claim?

If you currently have a workers’ compensation claim, in most cases you will still be able to make a TPD claim, depending on your circumstances. To fully understand your options, we recommend getting in touch with us to discuss the details of your TPD claim.

Can you claim TPD more than once?

You can make multiple TPD claims if you have more than one super fund and you are able to collect a TPD benefit from each superannuation fund you belong to for the same illness/condition.

Do I need a lawyer for a TPD claim?

It is best to obtain specialist legal advice when it comes to any claim for compensation as with the proper legal representation, you will be able to understand the possibilities and outcomes of your TPD claim with clarity. GC Law are specialist personal injury lawyers and we will assess your claim and advise you on how to proceed.

When should I contact a lawyer for my TPD claim?

We recommend seeking legal advice prior to commencing your TPD claim so that your case has the best chances of succeeding. To start your claim, either contact us direct on 1300 302 318 or visit our Free Case Review page and we’ll get back to you within 12 hours of receiving your request for help.

At GC Law we are no win no fee lawyers who are always upfront and honest about fees. This assures our clients peace of mind knowing that there are no hidden charges and all costs associated with your claim are disclosed prior to settlement.